YOU MUST ‘GET IN’ WITH ‘DE-FI’ + CRYPTO: Here’s How!

01.09.2020, 15:31

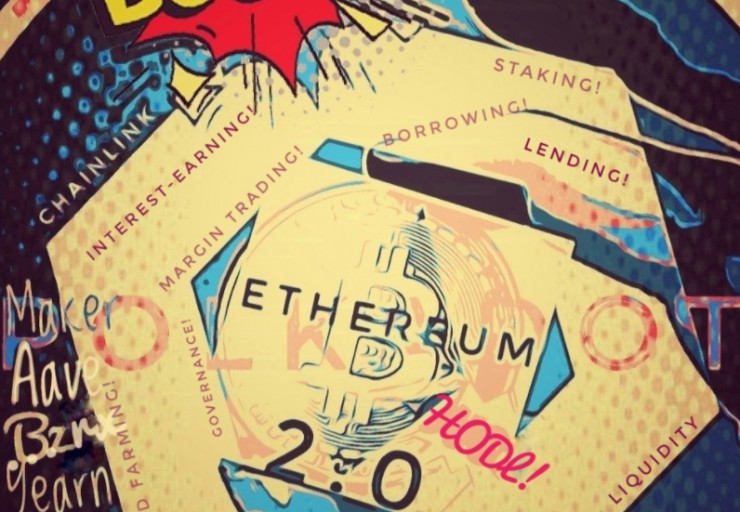

The bull market has returned to the crypto market, driven by uncertainty in traditional finance and also by the ‘De-Fi’ craze. Right now, money is pouring into De-Fi by more experienced crypto users who now trust the technology and smart contracts enough to ‘lock up’ their crypto in automated protocols and earn rewards. This is ‘decentralised finance’ which basically means ‘bankless’ borrowing, lending and compound interest earning, margin trading and liquidity providing. If you have some spare capital, or just want to explore options, then now is the time to put it to work!

Here at GrabFreeMoney.com, we keep our ears close to the ground for fresh money-making opportunities and continue to provide you with overviews on crypto and blockchain, which just so happens to offer some of the most exciting returns out there. You can swap your points earned with us for major cryptocurrencies - when you have enough saved up. So sign up to get your own dashboard today, and read how it all works first.

There is still risk involved with crypto, since ‘de-fi’ depends on the security of smart contracts, and those running - or governing - the protocols, where all this is still relatively new in the world. There are also high fees on the Ethereum network, preventing users with smaller sums from adding their funds and making it worthwhile… for now.

Staying Bullish

However, the market continues nonetheless, with high hopes on new projects that will free up Ethereum traffic shortly by creating bridges between chains or by implementing ‘layer-2’ scaling solutions. Investors with any foresight realise that Ethereum congestion may only be a temporary setback, where Ethereum 2.0 is also in the works.

There should soon be reductions in Ethereum-related transaction fees, which will see more and more users entering ‘de-fi’, beyond needing to place trust in banks. But if you’re not placing trust in banks, then you’re placing them in pure technology and the community ‘governance’ token structure that will run the blockchain protocols, and tokens responsible for governance have seen huge gains in value. Just check out the YFI token! You too may soon be voting on vital tokenomics network decisions.

Then there are the related projects with their tokens which operate to provide trusted data into smart contracts across multiple blockchains (not just Ethereum). Chainlink and Band protocol continue to rise in value and remain good investments. They are the integral force of de-fi.

It’s important to bear in mind that there is still risk with the state of the entire market too, which although is experiencing rapid innovation and investment, and application of blockchain network technology, could still be knocked sideways by major news in the global markets or the traditional stock market, including triggers from COVID-19. BUT... there is certainly a shift happening now, as any downturn in the market has so far (July onwards) met with dramatic recoveries and upswings.

Get Started with ‘De-Fi’ = Very Simple!

You might already have a Coinbase or similar account, or a crypto wallet of some kind. What you need next is to download the MetaMask browser or mobile wallet (which sync together).

Once you’re all set up, and have saved your private keys for this wallet somewhere, then you can load it up - with some Ethereum. Get some via Coinbase etc and send it to your new public address (in your MetaMask wallet).

This MetaMask application ‘wallet’ is your portal to accessing ‘de-fi’ dapps, either on websites directly in your browser, or from within the MetaMask wallet itself.

Next, we recommend going to https://zerion.io/. This Zerion app is brilliant for providing an overview of your Metamask contents and presenting you with options for ‘de-fi’. There is also a mobile Zerion app which works just as well, and syncs with MetaMask data.

That’s it! You’re now all set for crypto and de-fi adventures….

When it comes to swapping your Ethereum or exploring ‘de-fi’ options by sending tokens into various protocols, we highly recommend of course that you ‘do your own research’, or due diligence, before ‘Approving’ any related transactions from your MetaMask wallet (transacting on Ethereum).

Cryptos and Tokens to Watch

As you transact via MetaMask, you’ll need to approve any Ethereum gas fees, and right now you’ll notice these are very high even for small amounts. It’s wise to possibly wait until we see solutions arise. This doesn't mean you can’t still explore the options available directly via MetaMask (and Zerion).

Your research can start here. First, you’ll notice many stablecoins on Ethereum like DAI and USDC which are pegged to the price of the dollar. It’s always worthwhile keeping invested in stablecoin in case of downturns and because they now offer fixed, long-term compound interest returns. But your Dai etc. can also be put into protocols which now find the best, variable returns.

A major cryptocurrency to look into is Polkadot (DOT) now trading on major exchanges like Binance. It’s witnessing a huge rise, but it could grow much higher this year. Its next-generation blockchain technology has been developed by Ethereum co-founder Gavin Wood, of the Web3 Foundation, and promises to be the next launchpad for many ‘de-fi’ projects, as well as bridging or connecting to Ethereum and other blockchains. You can also stake your DOT tokens to support the network via the native mobile wallet.

You could also check out tokens like the OM token (available to buy with Ethereum via MetaMask at Uniswap token exchange) which is for next-gen de-fi project MantraDAO, and still at a great price.

We’ve already mentioned Chainlink (LINK) and BAND protocol. These still have huge growth potential as ‘de-fi’ promises to expand and rely more and more on their data feeds.

For safer options, Bitcoin and Ethereum remain integral to the market and, as the value of de-fi continues to grow in the market, these two will likely continue to see support.

New payment cards, beginning to handle direct, real-world payment with crypto are also in the works. Those with related tokens in competition are Swipe (SXP) and Crypto.com (CRO) and they will be ones to watch.

Conclusion

The time to ‘get in’ and start exploring directly (not via any third-party investment option) will open up a new world of finance to you and also long-term interest-bearing opportunities, in these times of economic uncertainty towards traditional banks, which look to offer little to no opportunities for savers.

Crypto is also not the stock market. Despite showing some correlation this may not last with the advent of ‘de-fi’ offering a dramatic alternative for long-term savers.

‘De-Fi’ and crypto are developing rapidly, and becoming easier to use all the time. I hope this article will help you keep up and get in this year, in the early cycles of the greatest advancement in tech since the rise of the web in the early 1990s.

Stay tuned to the GrabFreeMoney.com blog for the next post and more investment opportunities!

Contributed by Ade @ AdesPress.blog

Aug 2020

Disclaimer - Always do your own research. This is not professional financial advice so you invest at your own risk. The cryptocurrency market contains speculative and volatile projects so never invest more than you can afford to lose.

What is Ethereum and what can you do with it?

What is Ethereum and what can you do with it?

Tips on investing in Blockchain, plus top promising cryptocurrencies in 2020.

Tips on investing in Blockchain, plus top promising cryptocurrencies in 2020.

Putting your Ethereum to Work: Try these 4 ‘De-Fi’ Apps

Putting your Ethereum to Work: Try these 4 ‘De-Fi’ Apps

How to Invest & Trade Cryptocurrency (+automatically): Quant Trading!

How to Invest & Trade Cryptocurrency (+automatically): Quant Trading!

Blockchain Retail Investors: First we got into trading, now we’re into Dapps!

Blockchain Retail Investors: First we got into trading, now we’re into Dapps!

Investing in Digital Assets in Q3 (2020)? Consider these 5 Top Crypto Projects

Investing in Digital Assets in Q3 (2020)? Consider these 5 Top Crypto Projects

Why Bitcoin and Cryptocurrencies are still so exciting

Why Bitcoin and Cryptocurrencies are still so exciting

Binance: Not afraid to keep pushing

Binance: Not afraid to keep pushing