‘Liquidity Mining’ on the Binance Smart Chain (featuring Pancakeswap)

24.11.2020, 17:14

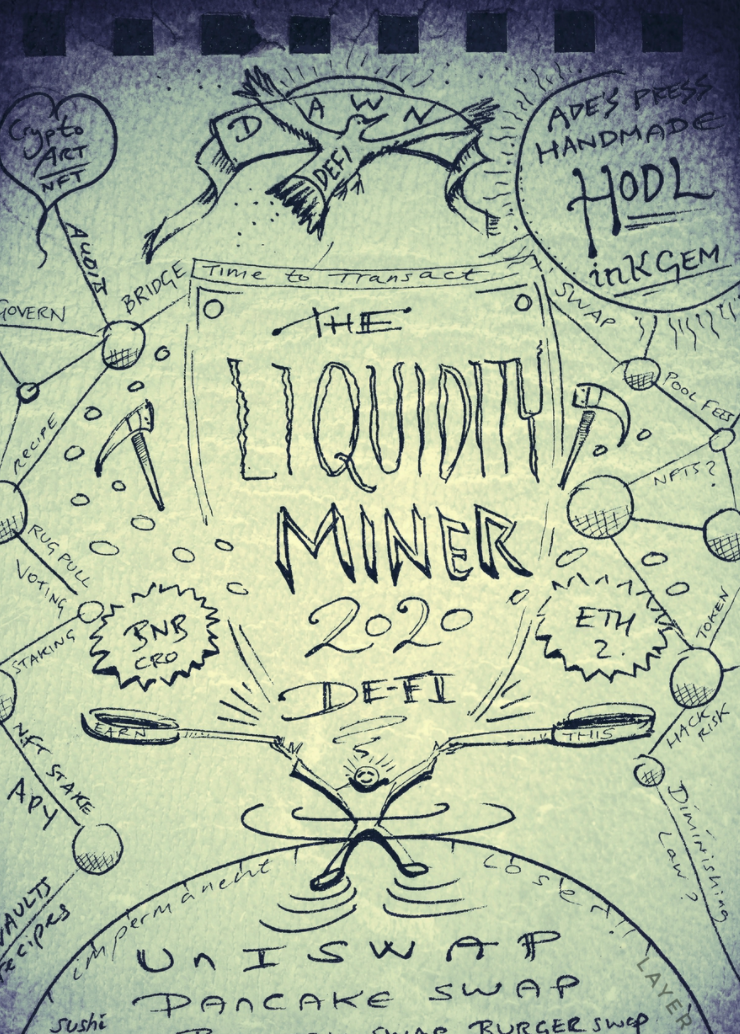

Image by ade’s press

Ethereum may be the hottest club in crypto town, and new projects that are doing brand new things with tokenomic wizardry can see their tokens shoot off in price like wine-corks on Christmas Day.

However, not everyone is a-wash like a ‘whale’ in crypto, or are prepared to pay the high fees just to transact on Ethereum. And, this is providing an ample opportunity for younger nightclub networks like the Binance Smart Chain to start attracting the masses.

There are already a number of platforms on the BSC blockchain which allow users to earn decent passive income by supplying liquidity (crypto) in various quantities of tokens, if you’re willing to accept the risks.

Here at GrabFreeMoney, we’ve been experimenting with these more accessible platforms. If you find it of interest then remember, you can swap your hard-earned points right here for major cryptocurrencies like Bitcoin and Etheruem, which can in turn be swapped for many more tokens listed on the likes of Coinbase or Binance. Sign up here to see how our points platform works.

What is Liquidity Mining?

Now, you may have heard about Ethereum and the latest, groundbreaking exchanges such as Uniswap, which provide a decentralized mechanism for any user to bring liquidity to a token, since anyone can earn rewards in the form of fees, or the platform token, like the UNI governance token.

However, slow transaction times and high fees as we transition to Ethereum 2 have led to a lot of frustration and a yearning for new, faster platforms.

Enter... Binance Smart Chain

The BSC blockchain (which uses the familiar BNB token for fees, as on its centralised exchange) has arrived at just the right time to catch on to the ‘de-fi’ trend and is witnessing increased usage and tokens being wrapped or bridged over onto the chain.

The results are fast, cheap and exciting, and new finance dapps are appearing everywhere, bringing traditional financial tools into this realm of automated protocols. They also vary in terms of what financial offerings they are looking to serve up.

If you want to start supplying liquidity for say, Chainlink (LINK) then you’ll need equal amounts of BNB and LINK (wrapped onto BSC via Binance etc.) to claim the relevant LP tokens, which are in turn staked into the ‘farms’ on Pancakeswap. Then you can start earning the CAKE token!

So far, Pancakeswap (and also Burgerswap, and the ‘Fast Food Alliance’), are proving themselves to be safe and reliable platforms. For this post we will cover Pancakeswap, since it’s currently the number one.

Risks

What are the risks? Well, protocol hacks and ‘smart contract risks’ are some, where unaudited platforms may have ‘coded in’ a back door, draining all the funds locked in their pools out of existence. It’s wise to stick to the better known, better audited and well-used sites if you’re providing a lot of liquidity, or invest only a small amount. Another risk - for liquidity miners - is called impermanent loss, which you can research here.

Despite such risks this is still an early, exciting time, and AMM platforms like Pancakeswap, which, despite the title, has been evolving impressively, continually developing ways to maintain or bring value to its $CAKE token.

Earn Tokens with your Tokens!

You don’t have to provide liquidity. Part of its successful formula right now has been to allow holders of its CAKE token to earn more CAKE simply staking it on the site. This staking can also then be used to farm new tokens via its ‘pools’.

This incentive not only highlights awareness for these new tokens and projects, but brings them essential liquidity and distribution. It also brings the prospect of attractive value for CAKE holders over time, by accumulating these new tokens via farming. The more CAKE you hold, the more tokens you can farm.

All this staking and farming helps prevent users taking the money and running off to some rival platform. It’s a lot like a complex ‘wheel of value’ that needs continually oiling with incentive. Maintaining a steady or growing price for CAKE is in fact the ideal scenario for the health of the platform.

Maintaining the price of CAKE

Pancakeswap is experiencing success so far, and it has also introduced mechanisms to ‘burn’ off excess CAKE being distributed and generated, via a Lottery (minimum 10 CAKE per ticket) and ‘IFO’s, where rewards can be achieved in a promising new token on BSC, but by first buying up LP tokens and surrendering CAKE.

Will the value of $CAKE continue? This all depends on the balancing of its tokenomics and the ways it can introduce new incentives for holders. Also, it will need to move to a more fully decentralised and trusted future, where governance and voting can also work effectively. Primarily, it should be the preferred place to exchange a wide array of tokens on BSC.

From Ce-Fi to De-Fi

The future is uncertain, but such rampant ‘de-fi’ continues to draw centralised Binance users and traders at an impressive rate into this more secure, decentralised ecosystem on its fast and efficient blockchain network. Perhaps since moving tokens around there is so fast and easy, and users no longer need to undergo intrusive security measures, since they retain direct ownership of their tokens, or investments at all times.

As these platforms grow (and possibly their attractive APY rates decline), whichever is the current leading platform will be the one which offers the highest level of trust and excites the most interest via the promise of new incentive, rewards and opportunities.

Collect your ‘Liquidity Miner badge’ 2020

Experiment...

The best way is to experiment personally using and staking at platforms like Pancakeswap.finance.

- Make the necessary changes to your Metamask wallet.

- Load your web3 wallet with BNB (wrapped for BSC).

- Exchange half of it for CAKE.

- Supply BNB and CAKE to withdraw your LP tokens via Pancakeswap.finance.

Pancakeswap could well prove itself to be a vital cog in this fresh (lucratively-backed) Binance playing field, where ‘de-fi’ mining and farming continues to create the first ‘killer dapps’ for its network BSC. It may even update its name and become a little more serious over time.

Happy mining and farming!

Stay tuned to GrabFreeMoney.com blog to get our next post featuring latest advice and investment opportunities, including those from the exciting, new crypto-verse.

Contributed by Ade @ Ade’s Crypto Press (Nov. 2020)

Also find more crypto-tips and NFTs at my site above.

Disclaimer - Always do your own research. This is not professional financial advice so you invest at your own risk. There is always risk with early projects. The cryptocurrency market contains speculative and volatile projects so never invest more than you can expect or afford to lose.

What is Ethereum and what can you do with it?

What is Ethereum and what can you do with it?

Tips on investing in Blockchain, plus top promising cryptocurrencies in 2020.

Tips on investing in Blockchain, plus top promising cryptocurrencies in 2020.

Putting your Ethereum to Work: Try these 4 ‘De-Fi’ Apps

Putting your Ethereum to Work: Try these 4 ‘De-Fi’ Apps

How to Invest & Trade Cryptocurrency (+automatically): Quant Trading!

How to Invest & Trade Cryptocurrency (+automatically): Quant Trading!

Blockchain Retail Investors: First we got into trading, now we’re into Dapps!

Blockchain Retail Investors: First we got into trading, now we’re into Dapps!

Investing in Digital Assets in Q3 (2020)? Consider these 5 Top Crypto Projects

Investing in Digital Assets in Q3 (2020)? Consider these 5 Top Crypto Projects

Why Bitcoin and Cryptocurrencies are still so exciting

Why Bitcoin and Cryptocurrencies are still so exciting

Binance: Not afraid to keep pushing

Binance: Not afraid to keep pushing